- 677

- 7 529 054

MeaningfulMoney

United Kingdom

Приєднався 22 кві 2010

Making sense of Money, with Pete Matthew. In these bite-size financial videos, I explain the basics of financial planning in easy-to-understand language. Money is not difficult to understand, but most people switch off to it. Hopefully I can help you first understand, and then use money to help you achieve your life's aims.

Some of the old videos need updating, so always check before you take action, and remember, nothing on here consitutes advice, OK?

Check out meaningfulmoney.tv for loads more, including an award-winning podcast.

Some of the old videos need updating, so always check before you take action, and remember, nothing on here consitutes advice, OK?

Check out meaningfulmoney.tv for loads more, including an award-winning podcast.

General Election 2024: How Will It Impact Your MONEY?

A general election is obviously a time of change, especially, as seems likely, we may end up with a change of government. Now there’s not going to be any political commentary here - instead I want to address the inevitable concerns that people have at a time of flux and uncertainty.

#meaningfulmoney #meaningfulacademy #generalelection2024

🔴 ua-cam.com/video/dc_nYwSuYMw/v-deo.htmlsi=J4qeAGgT85JR3OSl - Click here to watch "What if the Lifetime Allowance comes back?"

🔗 AJ Bell - How UK Markets have responded to past elections: www.ajbell.co.uk/articles/investmentarticles/276496/how-uk-equities-have-responded-past-general-elections

🔗 Timeline Investments: www.timeline.co/portfolios

👉 MeaningfulAcademy - Financial Foundations: meaningfulacademy.com/financialfoundations/

👉 MeaningfulAcademy - Build Wealth: meaningfulacademy.com/buildwealth

👉 MeaningfulAcademy - Retirement Planning: meaningfulacademy.com/retirementplanning

🏷️ Use PROMO Code "UA-cam" to save on any of the courses.

Chapters:

00:00 Intro

00:42 A political football

01:22 Don't try and plan when we don't know the outcome

02:34 Don't take action before July 4th

03:57 The long term matters more than the short term

04:59 Hold your nerve and hang in there for the long term

📙 The MeaningfulMoney Handbook: petesbook.com

The MeaningfulMoney Community (Facebook):

👉 meaningfulmoney.tv/community

👉 Life Insurance with LifeSearch: meaningfulmoney.tv/lifesearch

👉 Farewill - Discount off your Will: meaningfulmoney.tv/resources/wills-from-farewill

FOLLOW ME:

✔ Facebook: meaningfulmoney

✔ Twitter: meaningfulmoney

✔ Instagram: meaningfulmoney.tv

✔ LinkedIn: www.linkedin.com/in/petematthew/

✔ Website & Podcast: meaningfulmoney.tv

⚠️ IMPORTANT: Please be aware that MeaningfulMoney does NOT endorse or recommend ANY people or businesses claiming to be experts in crypto or other investments. We would never recommend you any investment strategies within the comments section. Please protect yourself against spam and misleading information from fake accounts and please do not share any private or sensitive information.

📫 Leave me a comment below - I read all of them and love hearing from you!

#meaningfulmoney #meaningfulacademy #generalelection2024

🔴 ua-cam.com/video/dc_nYwSuYMw/v-deo.htmlsi=J4qeAGgT85JR3OSl - Click here to watch "What if the Lifetime Allowance comes back?"

🔗 AJ Bell - How UK Markets have responded to past elections: www.ajbell.co.uk/articles/investmentarticles/276496/how-uk-equities-have-responded-past-general-elections

🔗 Timeline Investments: www.timeline.co/portfolios

👉 MeaningfulAcademy - Financial Foundations: meaningfulacademy.com/financialfoundations/

👉 MeaningfulAcademy - Build Wealth: meaningfulacademy.com/buildwealth

👉 MeaningfulAcademy - Retirement Planning: meaningfulacademy.com/retirementplanning

🏷️ Use PROMO Code "UA-cam" to save on any of the courses.

Chapters:

00:00 Intro

00:42 A political football

01:22 Don't try and plan when we don't know the outcome

02:34 Don't take action before July 4th

03:57 The long term matters more than the short term

04:59 Hold your nerve and hang in there for the long term

📙 The MeaningfulMoney Handbook: petesbook.com

The MeaningfulMoney Community (Facebook):

👉 meaningfulmoney.tv/community

👉 Life Insurance with LifeSearch: meaningfulmoney.tv/lifesearch

👉 Farewill - Discount off your Will: meaningfulmoney.tv/resources/wills-from-farewill

FOLLOW ME:

✔ Facebook: meaningfulmoney

✔ Twitter: meaningfulmoney

✔ Instagram: meaningfulmoney.tv

✔ LinkedIn: www.linkedin.com/in/petematthew/

✔ Website & Podcast: meaningfulmoney.tv

⚠️ IMPORTANT: Please be aware that MeaningfulMoney does NOT endorse or recommend ANY people or businesses claiming to be experts in crypto or other investments. We would never recommend you any investment strategies within the comments section. Please protect yourself against spam and misleading information from fake accounts and please do not share any private or sensitive information.

📫 Leave me a comment below - I read all of them and love hearing from you!

Переглядів: 15 418

Відео

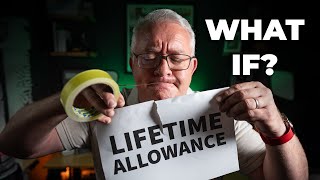

What If The Lifetime Allowance Comes Back?

Переглядів 22 тис.Місяць тому

The Pension Lifetime Allowance is now dead - it’s not a thing any more. But within hours of the Chancellor announcing its abolition in the March 2023 budget, the Labour Party said that it would reverse the decision if it wins the next general election. Well, we’re now only a few months away from that election, so what if the LTA does come back? Should you take action now in case it does? Or see...

Pension Tax-Free Cash - New Rules You Shouldn’t Miss

Переглядів 70 тис.Місяць тому

The Lifetime Allowance is no more, but its legacy lives on in some new rules about how much tax-free cash you can take when you crystallise your pensions at retirement. No surprises - the rules are complex and introduce a host of new impenetrable acronyms. Let me try to walk you through it. #meaningfulmoney #meaningfulacademy #lifetimeallowance 🔴 ua-cam.com/video/shSYKxJirY0/v-deo.html - Click ...

Investment Bonds Explained (not Premium, Corporate or Government Bonds)

Переглядів 14 тис.2 місяці тому

There’s a little-known kind of account which ANYONE who pays income tax can potentially benefit from. It’s been out of favour for a long time, but could now be making a comeback. So: Investment Bonds - are they boring, or could they be beneficial? #meaningfulmoney #meaningfulacademy #investmentbonds 🔴 ua-cam.com/video/TOx3pZlDHY4/v-deo.html - Click here to watch "How to invest for beginners wit...

How to invest for beginners with little money in 2024

Переглядів 40 тис.2 місяці тому

🔗 meaningfulmoney.tv/investing - Investment Cheatsheet 🔗 www.boringmoney.co.uk/learn/investing-guides/product-guides/online-investment-platforms/ - Boring Money Platform Guide #meaningfulmoney #stocksandshares #investing Watch these next: 🔴 How to choose investment funds: ua-cam.com/video/OIx8W6Z0mBA/v-deo.html 🔴 Automate your finances in 15 minutes: ua-cam.com/video/pGO5yKglqio/v-deo.html 🔴 In...

Why We Are Bad With Money (And How To Get Better)

Переглядів 17 тис.3 місяці тому

We are all wired to be bad with money. We just haven’t evolved to be able to cope with the complexity and abstract nature of planning our personal finances over decades. But it IS possible to get better by putting in place some simple ‘scaffolding’ that we can use to support our decision-making… #meaningfulmoney #meaningfulacademy #personalfinance 🔴 ua-cam.com/video/hUIo_IJuVEo/v-deo.html - Cli...

Automate Your Finances In 15 Mins

Переглядів 17 тис.3 місяці тому

The automation of our finances all centres around our income, and for the purposes of this, I want to chop our income into three bits - money for you, money for bills, money for spending. All three can be automated and in hardly any time at all - let’s get into it! #meaningfulmoney #meaningfulacademy #personalfinance 🔴 ua-cam.com/video/NCFwe-U9PLM/v-deo.htmlsi=CdpOXI1ZQ0ZxCXjF - Click here to w...

Invest For Growth - Beat Inflation - Retire Well

Переглядів 37 тис.4 місяці тому

Whenever I do a video where I quote something like a 6% return, I get tons of comments challenging my assumptions. Is it really possible to get a return on your money of 6%, 7%, 8% or more? Well, let’s find out… #meaningfulmoney #meaningfulacademy #inflation 🔴 ua-cam.com/video/hUIo_IJuVEo/v-deo.html - Click here to watch Retire Well On The Average Wage 👉 MeaningfulAcademy - Build Wealth: meanin...

Retire Well On The Average Wage

Переглядів 124 тис.4 місяці тому

I sometimes get accused of not talking about “normal person” levels of saving and investing, instead talking maximising ISA and pensions savings. Well, in this video I want to show you how saving small amounts can add up to really big outcomes. Spoiler alert, there’s no magic bullet, but it isn’t difficult either. #meaningfulmoney #meaningfulacademy #financialfoundations 🔴 ua-cam.com/video/5KC5...

The Wisdom Of Charlie Munger - 5 Lessons We All Can Apply

Переглядів 11 тис.5 місяців тому

Charlie Munger is famous for making AND giving away a boatload of money, and also for his wit and wisdom, being able to summarise very succinctly some timeless truths of investing, wealth building and life in general. Here are a few of my favourites, and at the end, I want to bring it all together to the one variable that we all can work on, whether we’re billionaires or still working to clear ...

The Seven Habits of FINANCIALLY Effective People

Переглядів 29 тис.5 місяців тому

What are the key habits that, if mastered and repeated throughout life, will GUARANTEE financial security? #meaningfulmoney #meaningfulacademy #financialhabits 🔴 ua-cam.com/video/y-4s1wqwQ7k/v-deo.htmlsi=geUwLl5AsxRziMGn - Click here to watch "Pension vs ISA" 🔴 ua-cam.com/video/Ic9hQgIUyow/v-deo.html - Click here to watch "How to review your finances" 👉 MeaningfulAcademy - Financial Foundations...

Will You Run Out? Income And Cashflow In Retirement

Переглядів 25 тис.5 місяців тому

Will you run out of money when you retire? Imagine you’ve worked all your life to save for retirement, but then you get to your late 70s and the money runs out, and you have to make big changes to how you live your life. Today, I want to run through how to avoid that, at all costs. #meaningfulmoney #meaningfulacademy #retirementplanning 🔴 ua-cam.com/video/7aZuznhQmGM/v-deo.html - Click here to ...

Investing Is DIFFERENT In Retirement

Переглядів 23 тис.7 місяців тому

Investing in retirement should be different to investing when you’re building wealth. The mechanics are largely the same; we use the same tools. But the weird thing is that we’re now investing not to build wealth, but so that we can spend down our money in a controlled fashion, over time, while factoring in fluctuating markets and our changing circumstances. That’s a lot to think about! 🚀 Here ...

The SIMPLEST Way To Invest

Переглядів 25 тис.7 місяців тому

There is no RIGHT way to invest; there are lots of ways. Each one will suit different people. But there is a SIMPLEST way to invest, I think, and in this masterclass, I’m going to walk you through it. #meaningfulmoney #meaningfulacademy #buildwealth 🚀 INVESTMENT CHEATSHEET: meaningfulmoney.tv/investing Check out my best teaching on personal finance at MeaningfulAcademy: 👉 MeaningfulAcademy - Bu...

If Money Could Be SIMPLE, What Would That Look Like?

Переглядів 10 тис.7 місяців тому

If money could be simple, more people would understand it. More people would be able to handle it. More people would avoid debt problems, and more people would be financially free. So if I could make things as simple as possible for you - what would that look like? #meaningfulmoney #meaningfulacademy #finance 👉 MeaningfulAcademy - Financial Foundations: meaningfulacademy.com/ff-1/ 👉 MeaningfulA...

Are You WASTING Your Hard-Earned Money?

Переглядів 24 тис.8 місяців тому

Are You WASTING Your Hard-Earned Money?

USING Pension Tax-Free Cash - YOUR Best Choice

Переглядів 50 тис.9 місяців тому

USING Pension Tax-Free Cash - YOUR Best Choice

5 Financial Mistakes you WILL regret

Переглядів 45 тис.9 місяців тому

5 Financial Mistakes you WILL regret

Pension Reforms: Take Back Control

Переглядів 81 тис.10 місяців тому

Pension Reforms: Take Back Control

6 Things That Will STOP You RETIRING

Переглядів 56 тис.10 місяців тому

6 Things That Will STOP You RETIRING

Tax-Free Cash Recycling - DON’T FALL Into This TRAP

Переглядів 29 тис.11 місяців тому

Tax-Free Cash Recycling - DON’T FALL Into This TRAP

How To Choose Investment Funds - Too Many Options?

Переглядів 24 тис.Рік тому

How To Choose Investment Funds - Too Many Options?

5 Finance Myths And How To Approach Them

Переглядів 17 тис.Рік тому

5 Finance Myths And How To Approach Them

Fabulous advice and far more important than anything you’ll ever hear from run-of-the-mill IFAs just trying too get their cut of your pension pot. Excellent.

If you wanna be successful, you most take responsibility for your emotions, not place the blame on others. In addition to make you feel more guilty about your faults, pointing the finger at others will only serve to increase your sense of personal accountability. There's always a risk in every investment, yet people still invest and succeed. You must look outward if you wanna be successful in life.

Even with the right technique and assets some investors would still make more than others, as an investor, you should’ve known that by now, nothing beats experience and that’s final, personally, I had to reach out to a stock expert for guidance which is how I was able to grow my account close to a million, withdraw my profit right before the correction and now I’m buying again.

What we want to know is, where do we invest ❓

Your knowledge pension surpasses any other I have encountered. Your content deserves a million subscribers.

Just stopped paying for ongoing advice. Was costing £1000 per month for a meeting lasting an hour once a year! Took me 7 years to waken up!!

Can't I simply say I'm a smoker to get a better rate and then give up smoking?

This makes me think of the saying there are no solutions only trade off's

Pension tax relief is my worry. I expect them to reduce the allowance from the 60k and there is talk of them changing the relief for higher earners isn’t great.

investing is all about taking educated guesses

lol

Wrong question. Debt free or mortgage 🤔🤨

I wish I knew about this when I was 20 rather than 40!

Great Video Pete, I hope you can do an update based on Labours Policy Manifesto released on Thursday (13th June). In the mean time I’m just wondering if there is any reason not to Crystallise all of a DC pension if it’s already above the last LTA / LSDBA eg. a £1.8m SIPP

Considering the increased complexity since the 2008 crash and COVID, I suggest diversifying your financial portfolio. I hired a manager and successfully grew my assets by over ($150K) during this turbulent market using defensive strategies that protect and profit from market fluctuations.

It's recommended to save at least 20% of your income in a 401k. You can use online calculators to estimate how much you should save based on your age and income. Saving at least 20% of your income in a 401(k) can help ensure that you have enough money to retire comfortably. By saving this much, you can take advantage of investing in the stock market and potentially grow your retirement savings over time.

I too would like to learn how to plkay the game. How did you get started? Can you point me in the right direction?

Search for Sharon Lee Peoples and do your own research. She has portfolio management down to a science.

Google Sharon Lee Peoples and do your own research. She has portfolio management down to a science.

Thanks for the share! copied and pasted full name on my browser, effortlessly found her site, very professional. I got some feedback hope to speak on the phone soon.

Good video, which has crystallised my interest in UFPLS. I'm glad that I built up most of my SIPP while being taxed at 40%, as that's my marginal rate in retirement. Had I only got 20% in relief, and were now being taxed at 40%, I'd be jolly miffed.

Warning from Liebour run Wales - you'll get screwed by council tax revaluation s and removal of the cap so 10% rises will be the norm.

First time here. Great explanation. UFPLS for me (age 64). Think I'll take 7% a year - and make sure I spend it. Why 7%? It's about what I reckon to get from my investments.

"Labour drops plan to reintroduce pension saving cap" from bbc news.

This is exactly what i was thinking, but worrying nonetheless. After watching you Pete, listening to your always sage advice and reading a lot of the comments here, I've carried on with my plan exactly as i intended. (Ever thought of running as prime minister Pete? 😉🤔) 👍

Hi Pete, I watch Toby Newbatt. Talks about investing. Great Chanell

Thank you for such an informative video. Will the successor need to pay tax when drawdown depend on the dying age of the previous successor or the original pension holder?

For my own peace of mind I am considering using my ISA allowance before the election. In previous years I have been scrambling around in the last week of March. What will the rules be in March 2025 ? As for changes taking a while to come through, I think most people agree that pre-announcing: 1) The ending of Dual MIRAS 2) The sale of the U.K's Gold Reserves Were both big mistakes. That is one per party to keep things even.

Not much has changed in the 13 years since this video to your more recent investment bonds video … good when the Government doesn’t tinker

Back ground music TOO loud

Imo there are many more things at stake in the country than my personal investments. The Tories have all but brought the uk to its knees and are lost at sea, aimless. They need time out of government to recombobulate. Im looking forward to a labour government, we need the change, and im not worried either about what policies they will implement, the two parties are not so far apart in reality, its more the viewpoint of each camp's support that wants them to be. England is a conservative country and starmer knows it.

7/7! As I have reached a point where I could retire the switch from net saver to net spender is messing with my head!😮😢😅

I'm really concerned about the LTA and potentially removing tax relief altogether if Labour get in and Rachel Reeves has been quite clear about not taxing working people more to pay for all their promises. Hard to see what to do about it though. I'm 60 this summer and was planning to retire but have decided not to (for other reasons). I'm paying in to my pension at 25% of salary but wondering how much Ill ever see back if the LTA returns.

Many thanks for sharing your thoughts, they are a great reassurance. I have found media coverage quite alarming and I think their objective is to influence voting decisions but what is unfortunate is that it makes people take irrational decisions along the way. I appreciate your calming words!

Thank goodness for a level head!! Well done Pete!

Quite. There will be time before a budget anyway, and Reeves is actually qualified for the job, unlike most of the many recent journeymen. If labour do want to cut NHS lists they will need toleave the LTA alone so senior people keep working.

Petes meaningful money material and the really helpful forum have been my main resource in "waking up" and plotting a sound financial future for myself and my family. The MM mantra of don't second guess a future government and carry on as before is a common theme. I'm only 90% with you on this one! I agree no change in investments or investment strategy is needed or wise. UK general election is a tiny blip in the global and temporal scheme of things. However I don't agree regarding possible future direction of taxation and thresholds. Everything we do in investing is placing a bet albeit sometimes one with good odds like "markets will always rise over the long term" For me there are bets that can be placed around future taxation and thresholds and opportunities to use allowances before they disappear or lessen. Whether action is required depends on personal circumstances and future goals. If Labour might re-introduce LTA and you are close to the old threshold perhaps it does make sense to contribute as much as you can now and benefit from some potential protections. If Labour might make pension contribution tax relief more fair and offer 30% across the board again perhaps this is a good time to think about maximising pension contributions this year rather than next if you are a higher rate tax payer. For me I had planned to make ISA and SIPP contributions this year and I'm wondering which to prioritise sooner rather than later. Which will be a target? But also how soon? Do chancellors have some levers they can pull they day after the election or does everything require legislation and we have months and possibly years to adjust?

I think the problem with many of these projections is that mortgage interest rate fluctuations are never really mentioned, only the stock market fluctuations. Our UK mortgage rate has gone from 3% (at the time of this video) to 5.3% in 2024. It’s a huge amount of money per month extra and I’m yet to see an example of this type. Would be great if you could do one, loving the videos so far!

Lets be honest, we're turkeys waiting for Christmas.

Great advice - clearly given, as someone about to retire so helpful Thanks

Pete, I'm a big fan of your videos. I remember watching this particular video when you first released it and thought it was great. Unfortunately, now that I understand tax and pensions much better, I am less sure it's as helpful as I thought it was when I first watched it. Multiple people have pointed me at this video when I've tried to correct their understanding of the advantages of a pensions vs ISAs. To be clear, I'm not arguing that there aren't plenty of compelling benefits in lots of circumstances, but there's some people who are confused about what these benefits are and seem to have picked up some misunderstandings from this video and other UA-cam content creator videos on this topic. Firstly, I love the idea of lettings the maths do the talking, but I believe that there are mistakes in the calculations. For example, the amount of money accumulated in the pension looks to be wrong. The pension number in the video is 20% more than the ISA number, but I think it should be 25% more. You could argue that using the large pension value would tip things further in the favour of pensions so the mistake doesn't matter much in video in which you are advocating for pensions. But it does risk undermining confidence in letting the maths do the talking if the maths looks to be wrong. The comparisons of ISA vs pension values during retirement (e.g. at age 100) are comparing net value (in the case of the ISA) with the gross pre-tax value (in the case of the pension). I think saying "So they are more than £500,000 better off" is very misleading given this. If this particular comparison use the net values for both (apples to apples) and if the maths didn't have errors in it, then the ISA and pension would have exactly the same net value. This is because this example is assuming zero tax free cash and base rate of tax both at contribution and withdrawal time. It's the tax free cash and any difference between the effective tax rate saved at contribution time vs the effective tax rate at withdrawal time, that makes pensions perform better than ISAs in the pure numbers game. Given this, I think people could easily reach the wrong conclusion given this part of summary: “Yes you are taxed on the back end with pensions, but the growth and compounding on the tax relief is so so valuable. Really doesn't take that much to reach this critical mass so that you really can't undo the benefits of that growth.” On the other hand if you have an employer who is happy to match contributions in a salary sacrifice scheme (in a sense converting reduced NI into contributions) then that is really free cash in my mind. Though I realise that's beyond the scope of this video where it was keeping things simple. The IHT benefit is likely a huge deal for many people. But I think the video distorts this somewhat by comparing the net value of the ISA with the gross pre-withdrawal value of the pension. The video does mention there will be potential income tax to pay but brushes this aside as not wanting to muddy the waters. It might have been more helpful to assume beneficiary withdrawals would be subject to the basic rate of tax as a reasonably representative lower estimate of the tax they might incur. A couple of benefits of pensions compared to ISAs that are not related to better tax treatment which are often overlooked: 1) I believe that ISAs are included in means tested benefit calculations, so while an ISA gives you that emergency fund, you might end up having to spend it in circumstances you didn't expect to have to (such as illness or redundancy); 2) you generally get better annuity rates and more annuity escalation options when purchasing using a pension rather than cash purchase (e.g. you can't get a money purchase index linked annuity). I hope this feedback is helpful. I really like the content you produce and have learned a lot from your videos. If you are ever developing a v2 of this video, hopefully these ideas are something you can consider and are useful. I know you've done a couple on the abolition of the LTA and new tax free cash rules. But perhaps a v2 of "pensions vs ISAs" might still be useful? Who knows it might even get another 500k views?

Hi Alex - I spotted this comment a couple of weeks or so ago, but have only now had chance to sit down and pull out the spreadsheet I used for the video calculations. Imagine my horror on realising that I had actually understated the contribution to the pension vs the ISA! I can't actually believe that it's taken three years for anyone to spot that, but you're right - even though it makes the pension look worse that it will in fact be, it doesn't engender confidence. I don't think I've ever made such a maths blunder - a bit worrying, but I'll blame it on brain fog from hormone-induced chronic fatigue at the time... I think the death benefit comparison is a bit more subjective. I've yet to have any beneficiary of a post-75 drawdown plan take the lot out in a lump sum, incurring potentially higher or even additional rate income tax in doing so, so I think the comparison stands in this case. I'll also stand by the critical mass statement, for now at least! As I was talking in the summary about the pension holder's point of view rather than that of any future beneficiaries. You just know I'm going to revisit this video now! And I'll seek to address some of your other points in that, too. I'd like to thank you for the gracious nature of your feedback. Plenty of people would be snarky, but you haven't been and for that, I'm very grateful. Now I'm off to self-flagellate to punish myself for incorrect maths, which I really can't quite believe...

Disappointed not to see a Crew shirt in this one!

They really should sponsor me, right?!

Retiring in 2 yrs and looking to change my advisor who is associated with a bank/brokerage firm. I need someone who will do estate planning, 407 conversion and maximize our social security. This was very informative

hopefully we will see a return to favouring the young and future investment rather than destroying the country for the sake of the grey vote.

Amen to that!

Totally agree!

whole thing sounds like some sort of scam, no wonder wages have stagnated with more paperwork and expenses for employers.

Hi Pete, how is the remaining 75% held in drawdown on a crystalised amount, is it in cash at a nominal interest rate, I am 100% VG Dev Wrld ETF for my sipp, and would want the potential for growth for any money not drawn, if it is classed as investments sold then option 3 sounds better ? Excellent vid as always, I watch them all, please keep up the good work !👍

Another very helpful and topical video - but unless I missed it, you focused exclusively on British markets, using FTSE to illustrate your points - surely spreading investments globally protects against any potential political events in any single country?

Yes, I did focus on the FTSE only because it's likely to be most directly affected (but only in the short term!) by the UK election. The message is global though - don't sweat the short term and focus on the long term

"without annoying us to the point where we start rioting" - brilliant!

I feel like it, sometimes!

Some of us remember the Poll Tax (which personally I didn't have a problem with).

Totally agree Pete. Any significant change (e.g. ISA, LTA, IHT etc) will take years to transition. Keep investing what you can afford

Amen, brother!

Thanks for that reassurance, excellent 👍

Glad it was helpful - thank you for watching!

Thanks Pete, my dad used to say his investments always did better under a labour government, I never bothered checking.

Be interesting to know for sure, right? Check out the AJ Bell article in the description - makes for interesting reading. But, it's history!

+1 During the last 45yrs I always did one vital and important thing during general elections. I sat on my hands. (Enabled me, in part, to retire early 6 weeks ago...)

Congrats on your retirement! And thanks for reinforcing the message!

Will it be possible to do a podcast on FU Money if this actually exist

I agree with what you're saying,but as someone trying to build a small pot to use in the first few years of retirement in 3 years time, i fear an incoming Labour government. The last Labour Government "stole" my last pension, whats left is sitting in the Pension Protection Fund, I'd like to leave it there a few more years before touching it. Thanks to Gordon Brown I'm still working rather than retired.

Oooff, that sucks - I can see why you might be a bit jaded about it all... I guess you probably want to stick to deposits and get the best interest rate you can, given the short timescale. OR split the difference - invest some and deposit some. Good luck!

I’m in the same situation I have 15 years of final salarie pension in the ppf a quarter of it lost and only rising a maximum of 2.5 percent a year if I’m lucky , I’m taking out the max they let me and putting into a 5 percent isa this year , whilst at the same time paying 24 percent into my works pension since I was 35 Going to let that one ride the stock market storms until 75 🎉

@@flustered1939 As a small consolation a large chunk of my DB pension will go up a maximum of 2.5% a year once in payment. However, I have read that before Gordon Brown introduced that rule there was no obligation for companies to increase in payment pensions at all !

What would your advice be to someone who is waning to make a lump sum payment into their pension? Delaying it would be a form of futile market timing and paying it a month before the election feels like something that can wait...

Toss a coin, maybe?! Seriously - I'd get it into the market. Yes, you may be worse off in the short term if the markets react badly to the election results, But they will return to form in due course, because they always do. Make a decision and the DON'T second-guess it. Live with it, whatever the outcome, knowing that you did your best and you can't know the perfect path in advance, only in the rear-view mirror.

cheers Pete appreciate the guru shout out to keep the course :)

No worries. Always good to have you on here, MiniMad!